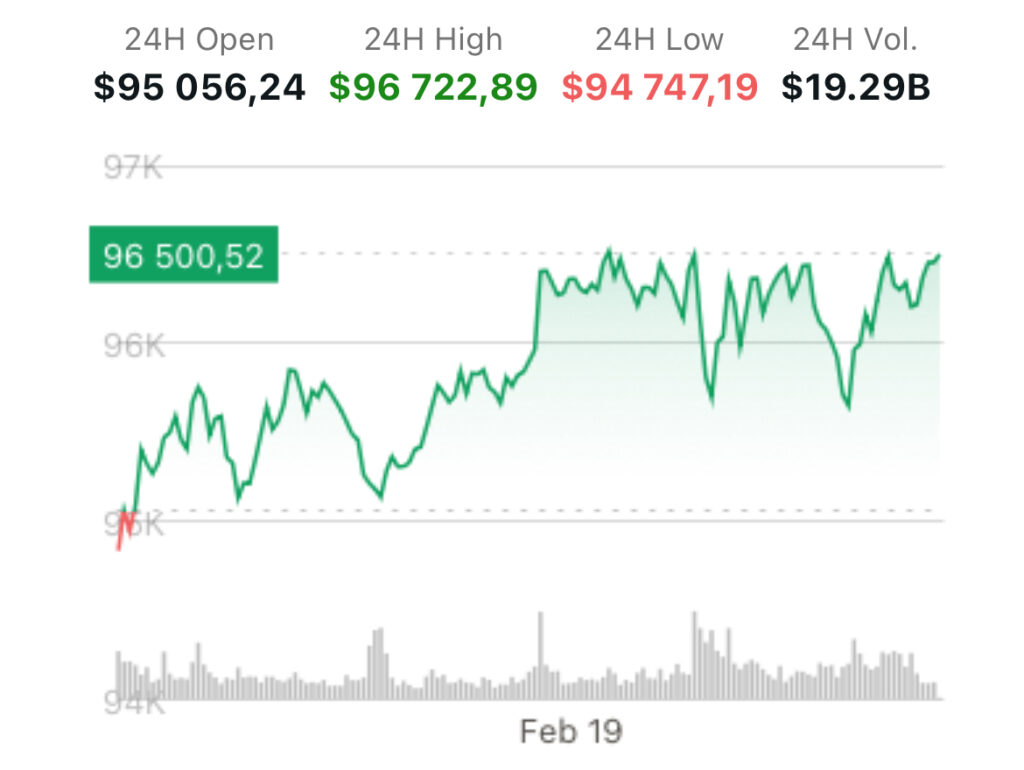

📈 Bitcoin Price Analysis – February 19, 2025

The current price of Bitcoin (BTC) is $96,387, reflecting a 1.33% increase over the last 24 hours. The cryptocurrency market has been experiencing some fluctuations, but Bitcoin remains resilient and continues to hold its ground above $95,000. Cryptocurrency’s future is under ongoing debate. Today’s analysis will explore the key factors influencing the market. It will also look into the potential price movements over the coming days.

🔍 Key Events Impacting Bitcoin Price

1. MicroStrategy’s Large Bitcoin Purchases

One of the significant developments driving Bitcoin’s price is the ongoing accumulation by major institutions. MicroStrategy, the largest publicly traded Bitcoin holder, has been purchasing large amounts of Bitcoin, continuing its strategy of adding the cryptocurrency to its balance sheet. Recently, the company announced it would issue $2 billion in convertible bonds to purchase even more Bitcoin, pushing its total holdings toward 480,000 BTC.

This move by MicroStrategy strengthens the long-term bullish sentiment surrounding Bitcoin. The company’s actions suggest a firm belief in Bitcoin as a store of value, potentially leading other institutional investors to follow suit. This accumulation behavior is also an important factor in keeping Bitcoin’s price from falling significantly.

2. Rising Inflation and Fed Interest Rate Hikes

On the other hand, global macroeconomic conditions are creating headwinds for Bitcoin. Higher-than-expected inflation figures in the U.S. have sparked concerns about further interest rate hikes from the Federal Reserve. If interest rates rise significantly, it could reduce investor appetite for riskier assets like Bitcoin, as the returns from traditional investments (like bonds) become more attractive.

These concerns caused a brief dip in Bitcoin’s price below $95,000, but the cryptocurrency rebounded quickly. Investors are watching closely to see whether the Federal Reserve will maintain a hawkish stance in the coming months, as this could trigger increased volatility in the crypto market.

3. Outflows from Cryptocurrency ETFs

Another notable event affecting Bitcoin’s price is the $415 million in outflows from cryptocurrency-linked exchange-traded funds (ETFs). This marks the end of a 19-week streak of inflows into these funds, signaling that institutional investors may be pulling back in response to tightening monetary policies and the overall market uncertainty.

While this could indicate a temporary decrease in institutional demand for Bitcoin, it is important to note that the market remains highly speculative, and shifts in institutional sentiment can occur quickly. ETF outflows may lead to a short-term drop in Bitcoin’s price, but the long-term outlook remains positive as institutional adoption of cryptocurrencies continues.

📊 Technical Analysis: Where Is Bitcoin Heading?

Now, let’s take a closer look at Bitcoin’s price action from a technical perspective. Bitcoin has been trading in a broad range, with key levels of support and resistance that traders should watch closely.

Support Levels

The immediate support level for Bitcoin is $92,324. This level has proven to be a strong point where buyers have stepped in to push the price higher. If Bitcoin’s price falls below this level, it could trigger additional selling, leading to a possible retest of the $85,000 level. Traders should watch for signs of buying interest around this zone to determine whether the bulls will step back in.

Resistance Levels

On the upside, Bitcoin faces significant resistance around the $110,000 level. A break above this level could signal that Bitcoin is poised for a continued rally. If this resistance is taken out, the next target could be around $120,000. The current market sentiment suggests that Bitcoin has the potential to break through this level, but macroeconomic factors like inflation and interest rate hikes could hold it back in the short term.

Trend Analysis

Bitcoin is currently in a consolidation phase, as it trades within a range of $95,000 to $97,000. The market is waiting for a catalyst to push prices in either direction. A decisive move above $97,000 would indicate strong bullish momentum, while a move below $92,000 could signal a bearish trend. Traders and investors should pay close attention to any developments regarding inflation, interest rates, and institutional investments, as these could be the key factors driving Bitcoin’s price in the coming weeks.

💡 Strategic Insights for Bitcoin Investors

Bullish Strategy

For those with a bullish outlook, the key levels to watch are the $97,000 resistance and the $92,000 support. If Bitcoin breaks above $97,000 and closes strongly above this level, it could be a signal to buy in anticipation of further upside. A break above $110,000 would solidify the bullish case and open the door for further price targets around $120,000.

Bearish Strategy

On the flip side, if Bitcoin drops below $92,000 and fails to regain that level, it may be time to consider short positions. In this case, the next potential support levels to monitor are around $85,000.

Risk Management

Regardless of your trading strategy, it’s crucial to employ sound risk management practices. Set stop-loss orders and consider diversifying your portfolio to protect against large price swings. Since Bitcoin and the broader crypto market can be highly volatile, ensuring that your risk tolerance aligns with your trading plan is essential.

📊 Bitcoin Market Outlook for the Coming Week

Looking ahead, Bitcoin’s price action will likely depend on the macroeconomic environment. If inflation remains high and the Federal Reserve continues to increase interest rates, we could see additional volatility in the market. However, if institutional buyers remain active and continue to accumulate Bitcoin, the overall market sentiment should stay positive.

Traders should watch for any signs of economic instability or changes in investor sentiment that could affect Bitcoin’s price. As always, it’s important to stay informed and adapt to the evolving market conditions.

Bitcoin’s price has been resilient despite macroeconomic concerns. The next few days could be crucial in determining whether Bitcoin can break through the key resistance levels and continue its upward trajectory or face a deeper correction. Traders should closely monitor price action around the $92,000 and $97,000 levels to make informed decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Internet Computer

Internet Computer  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic