📈 Ethereum Price Analysis – February 19, 2025

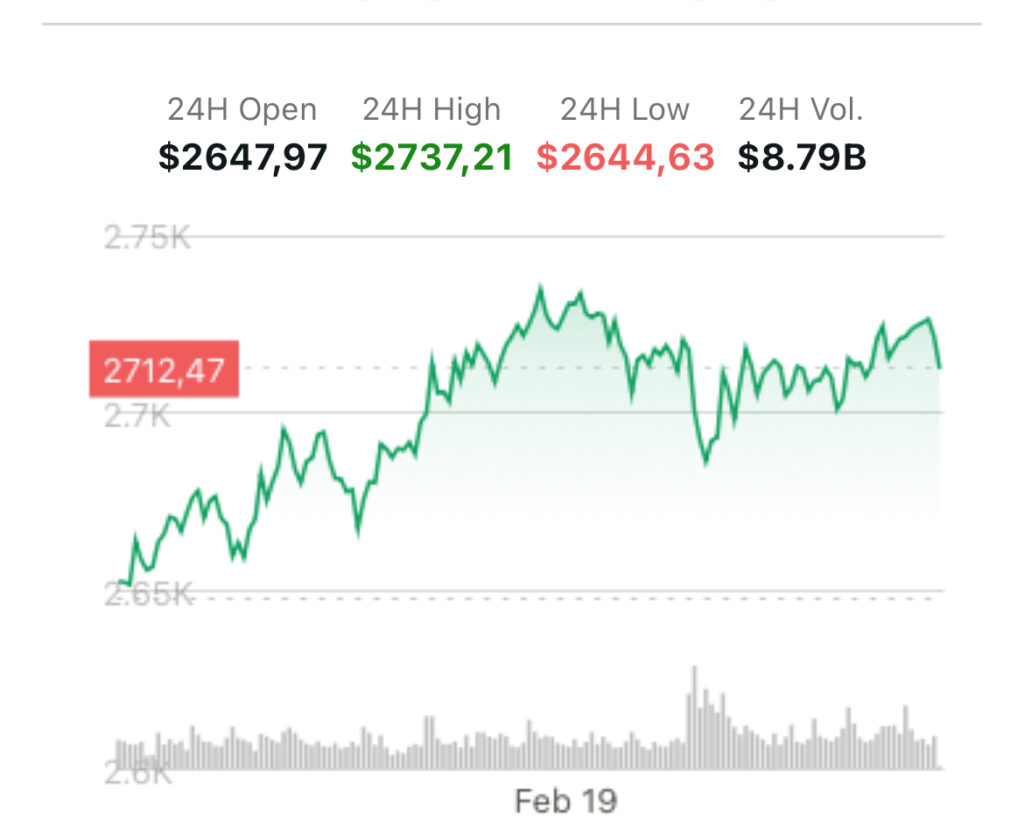

As of February 19, 2025, Ethereum (ETH) is trading at $2,718.81, showing a slight increase of 0.02793% over the past 24 hours. The cryptocurrency market remains highly dynamic, and Ethereum continues to hold a strong position. In this analysis, we will examine the key factors influencing ETH’s price and potential market movements in the coming days.

🔍 Key Factors Influencing Ethereum’s Price

1. Growing Interest in Ethereum’s Ecosystem

The total value locked (TVL) in Ethereum-based decentralized applications (DApps) has been increasing, reflecting growing interest from institutional and retail investors. This suggests that Ethereum’s role in DeFi, NFTs, and smart contracts remains crucial, potentially supporting long-term price appreciation.

2. Technical Breakout Potential

Ethereum’s price is approaching a key resistance level at $2,850, which has historically acted as a barrier. If ETH successfully breaks above this level, the next target could be $3,000. However, failure to sustain this momentum could result in a pullback toward the $2,650 support level.

3. Upcoming Ethereum Network Upgrades

Ethereum’s ongoing development, including enhancements in scalability and security, continues to attract investor confidence. The anticipated implementation of upgrades aimed at reducing transaction costs and improving speed may further boost adoption and demand for ETH.

📊 Technical Analysis: Support & Resistance Levels

Ethereum’s price movements are guided by several key support and resistance zones:

Support Levels

• $2,650 – A critical support level. A break below this could trigger further downside movement.

• $2,500 – A major psychological support level. A drop below this could indicate a bearish trend.

Resistance Levels

• $2,850 – The immediate resistance level. Breaking above this could push ETH toward $3,000.

• $3,000 – A key psychological level. Surpassing this could indicate strong bullish momentum.

💡 Market Scenarios and Trading Strategies

Bullish Scenario

If Ethereum holds above $2,650 and breaks past $2,850, it may gain the momentum needed to reach $3,000. Positive sentiment surrounding upcoming upgrades and growing institutional adoption could further fuel this rally.

Bearish Scenario

If Ethereum fails to break above $2,850 and falls below $2,650, it could trigger a bearish trend, with potential declines toward $2,500. Macroeconomic factors, such as regulatory uncertainty or market-wide corrections, could contribute to downward pressure.

Risk Management Tips

• Use stop-loss orders to minimize losses in case of unexpected volatility.

• Diversify your portfolio to reduce exposure to a single asset.

• Monitor technical indicators such as RSI, MACD, and moving averages to confirm trends.

📅 Key Events to Watch

• Ethereum Network Upgrades – Any major updates to Ethereum’s blockchain could impact price movements.

• Regulatory Developments – Global regulatory changes affecting crypto markets may influence Ethereum’s adoption and price trends.

• Institutional Interest – Increasing participation from institutional investors could drive further price growth.

Ethereum remains one of the strongest assets in the cryptocurrency market. While its price shows signs of stability, upcoming events and technical patterns suggest potential volatility. Traders and investors should remain cautious and adapt their strategies based on market conditions. Whether ETH breaks past $3,000 or experiences a temporary pullback, monitoring support and resistance levels will be key in navigating the next moves.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Internet Computer

Internet Computer  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic