Bitcoin (BTC) Price Analysis and Forecast for February 22–24, 2025

Current Market Situation

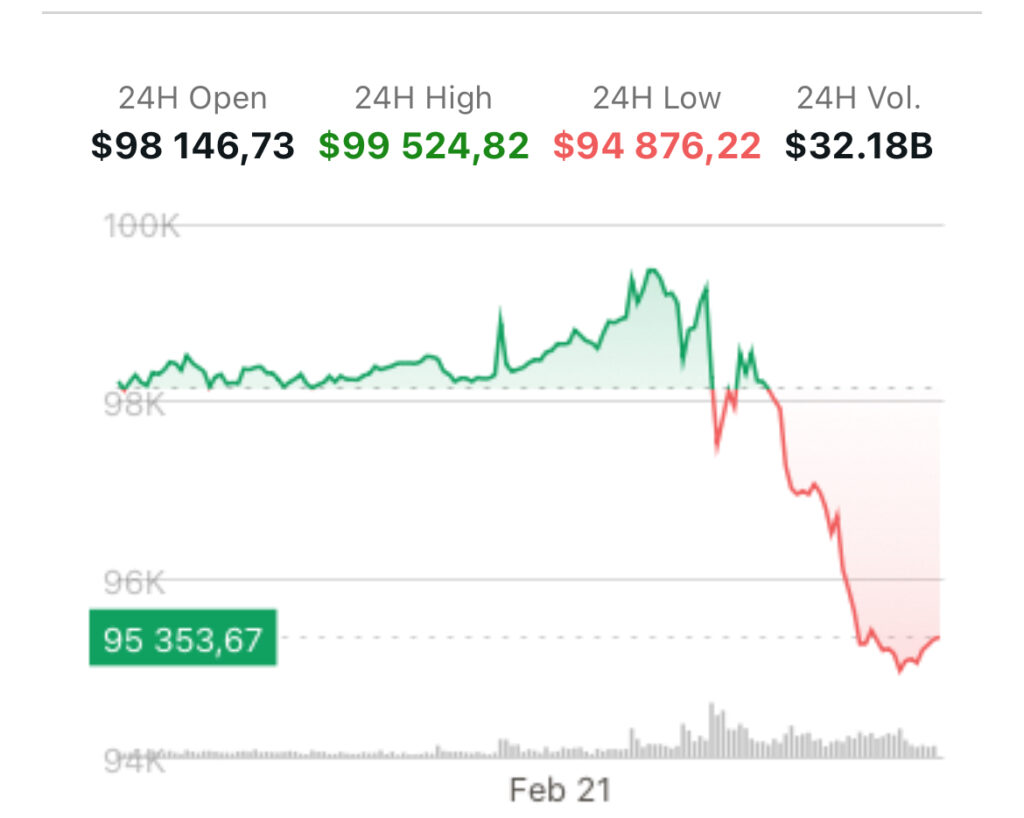

As of February 21, 2025, Bitcoin (BTC) is trading at approximately $95,420, reflecting a 2.74% decline from the previous close. During the day, BTC reached a high of $99,505 and a low of $94,907.

Technical Analysis

Key Support and Resistance Levels

• Support: $94,000, $90,500

• Resistance: $100,000, $105,000

Bitcoin is approaching the psychological level of $100,000, which is a significant resistance. A breakout above this level could pave the way for further gains towards $105,000. Conversely, a drop below $94,000 could suggest a correction towards $90,500.

Technical Indicators

• RSI (Relative Strength Index): Currently at 60, indicating a neutral sentiment with a slight bias towards buyers.

• MACD (Moving Average Convergence Divergence): The MACD line is above the signal line, suggesting a possible continuation of the upward trend.

• SMA (Simple Moving Average) 50 and 200 days: BTC is trading above both the 50-day and 200-day moving averages, confirming the long-term upward trend.

Factors Influencing the Price

• Regulations: The U.S. Securities and Exchange Commission (SEC) has eased oversight on cryptocurrencies, positively impacting market sentiment.

• Institutional Adoption: An increasing number of firms and financial institutions are incorporating Bitcoin into their investment portfolios, boosting demand for the cryptocurrency.

• Macroeconomics: Expectations of a more dovish monetary policy in the U.S. may prompt investors to seek alternative assets like Bitcoin.

Forecast for the Next 3 Days (February 22–24, 2025)

Optimistic Scenario

If Bitcoin manages to break through the $100,000 level, further growth towards $105,000 is possible. Supporting factors for this scenario include:

• Ongoing easing of cryptocurrency regulations in the U.S.

• Increasing institutional investor interest.

• Positive macroeconomic data favoring riskier assets.

Pessimistic Scenario

If Bitcoin fails to hold the $94,000 level, a correction towards $90,500 is likely. Risk factors include:

• Sudden tightening of regulations or negative news about cryptocurrencies.

• Profit-taking by large investors, leading to increased supply in the market.

• Negative macroeconomic data prompting investors to avoid risk.

Long-Term Forecast

Analysts predict that Bitcoin could reach $200,000 by the end of 2025, driven by growing institutional adoption and limited supply. However, investors should be aware of the high volatility in the cryptocurrency market and adjust their investment strategies according to their individual risk tolerance.

Bitcoin is at a crucial juncture, approaching the psychological barrier of $100,000. A breakout above this level could lead to further gains, while a failed attempt could result in a correction. Investors should closely monitor both technical indicators and fundamental factors to make informed investment decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Ondo

Ondo